Supply Chain Finance Market Overview:

The Supply Chain Finance (SCF) Market is experiencing rapid growth, driven by the increasing need for businesses to optimize working capital and streamline their supply chains. In 2022, the market was valued at USD 83.4 billion and is expected to grow to USD 93.07 billion in 2023. Projections indicate that by 2032, the market will reach USD 250.0 billion, with a compound annual growth rate (CAGR) of 11.6% from 2024 to 2032.

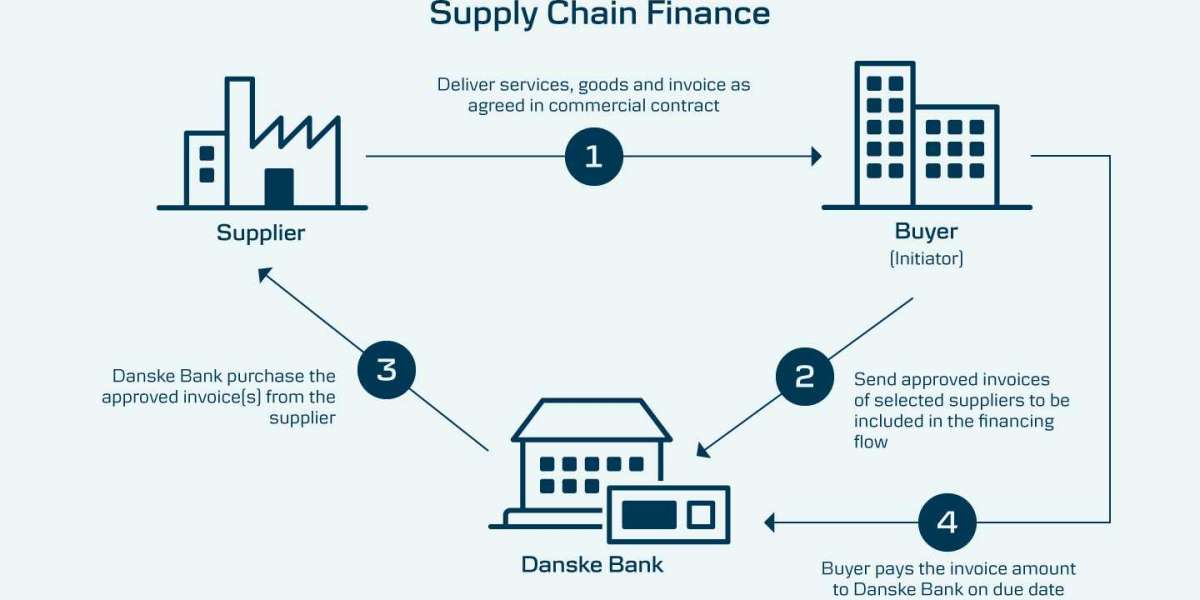

Overview of Supply Chain Finance

Supply chain finance refers to a set of financial tools and solutions that help businesses manage their supply chain payments more effectively. SCF optimizes working capital for both buyers and suppliers by allowing suppliers to receive early payment on their invoices, often at a lower cost, while enabling buyers to extend payment terms without negatively impacting supplier relationships.

In a competitive business environment, companies are turning to supply chain finance to reduce costs, enhance liquidity, and build stronger relationships with their suppliers. SCF solutions are becoming increasingly important in industries with complex supply chains, such as manufacturing, retail, and automotive sectors.

Request For Sample Report PDF - https://www.marketresearchfuture.com/sample_request/24696

Key Market Drivers

Several factors are contributing to the growth of the supply chain finance market:

1. Demand for Working Capital Optimization

Many businesses are seeking ways to improve their cash flow and working capital management. SCF solutions provide a win-win scenario for both buyers and suppliers, helping companies manage payment terms more effectively, reduce financial risks, and optimize liquidity across the supply chain.

2. Globalization of Supply Chains

As supply chains continue to expand across borders, businesses are facing challenges in managing payments and financial risks associated with international trade. SCF solutions help mitigate these challenges by offering flexible financing options, enabling businesses to operate more efficiently in global markets.

3. Rising Adoption of Digital Supply Chain Solutions

Advancements in technology have significantly improved the efficiency of supply chain finance. Digital platforms and blockchain-based solutions are enabling more transparent, automated, and secure financial transactions across the supply chain. This digital transformation is accelerating the adoption of SCF solutions among businesses of all sizes.

4. Growing Focus on Sustainability

Sustainable supply chain practices are becoming a priority for businesses across the globe. Supply chain finance can support these efforts by providing financial incentives to suppliers who meet sustainability goals, such as reducing carbon emissions or adhering to ethical labor practices. This focus on sustainability is driving the integration of SCF into business strategies.

5. The Impact of COVID-19

The COVID-19 pandemic disrupted global supply chains, leading to a heightened awareness of the importance of liquidity management. Businesses have increasingly turned to SCF solutions to ensure financial stability and maintain strong supplier relationships during uncertain times. The pandemic accelerated the need for resilient, flexible supply chain financing mechanisms.

Challenges Facing the Market

Despite its promising growth, the supply chain finance market faces several challenges:

1. Regulatory and Compliance Issues

Supply chain finance solutions must navigate complex regulatory environments, especially when operating across multiple countries. Compliance with trade finance regulations and anti-money laundering (AML) rules adds operational complexities for SCF providers and businesses alike.

2. Adoption by Small and Medium Enterprises (SMEs)

While large corporations are increasingly adopting SCF solutions, many small and medium-sized enterprises (SMEs) face barriers to entry due to limited access to financing and technological resources. Ensuring that SCF solutions are accessible to SMEs remains a key challenge for the market.

3. Technological Integration

Implementing SCF solutions requires seamless integration with existing enterprise resource planning (ERP) systems, financial platforms, and supply chain management tools. Companies need to invest in technology infrastructure to fully realize the benefits of SCF solutions, which can be a challenge for businesses with legacy systems.

Market Segmentation

The supply chain finance market can be segmented by solution type, deployment model, and end-user industry:

By Solution Type:

Receivables Discounting

Dynamic Discounting

Inventory Finance

Payables Finance

By Deployment Model:

Cloud-Based SCF Solutions

On-Premise SCF Solutions

By End-User Industry:

Manufacturing

Retail

Healthcare

Automotive

Aerospace Defense

Regional Insights

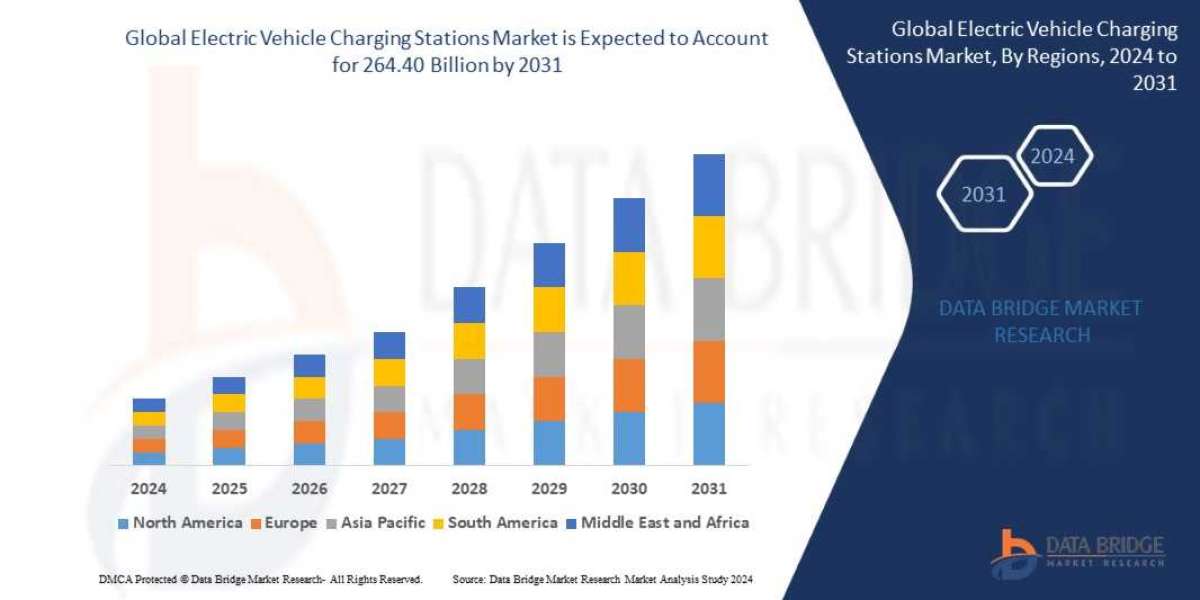

1. North America

North America is expected to hold a significant share of the supply chain finance market, driven by the region’s well-established financial infrastructure, widespread adoption of digital solutions, and strong demand for working capital optimization. The U.S. remains a key player in the SCF market, with many businesses leveraging SCF solutions to maintain liquidity and supplier relationships.

2. Europe

Europe is another major region for the supply chain finance market, with countries such as Germany, the UK, and France adopting SCF solutions at a rapid pace. The region’s focus on sustainability and environmental, social, and governance (ESG) criteria is influencing the adoption of green SCF solutions, particularly in industries like manufacturing and retail.

3. Asia-Pacific

Asia-Pacific is projected to witness the fastest growth in the supply chain finance market due to the region’s expanding manufacturing base, increasing cross-border trade, and growing demand for financial inclusion. China, India, and Japan are key drivers of SCF adoption in this region.

4. Latin America, Middle East, and Africa (LAMEA)

LAMEA is also experiencing growth in the SCF market as businesses in emerging economies adopt SCF solutions to support trade and supply chain resilience. Financial institutions in these regions are increasingly offering SCF products to improve access to working capital for local businesses.

Future Outlook

The future of the supply chain finance market looks promising, with strong growth anticipated over the next decade. As businesses continue to seek ways to improve working capital, mitigate risks, and enhance supply chain resilience, SCF solutions will play an increasingly important role in global trade and financial management.

Advancements in digital technology, coupled with the growing need for sustainable supply chain practices, will further drive the adoption of SCF solutions. Additionally, the rise of fintech innovations and blockchain applications is expected to reshape the SCF landscape, offering new opportunities for businesses and financial institutions alike.

Conclusion

The Supply Chain Finance Market is set to experience robust growth, with a projected CAGR of 11.6% from 2024 to 2032. Reaching USD 250.0 billion by 2032, the market will be driven by the increasing need for working capital optimization, the globalization of supply chains, and advancements in digital finance solutions. Despite challenges such as regulatory compliance and technological integration, the SCF market holds immense potential for businesses looking to enhance liquidity and build resilient supply chains in the years to come.