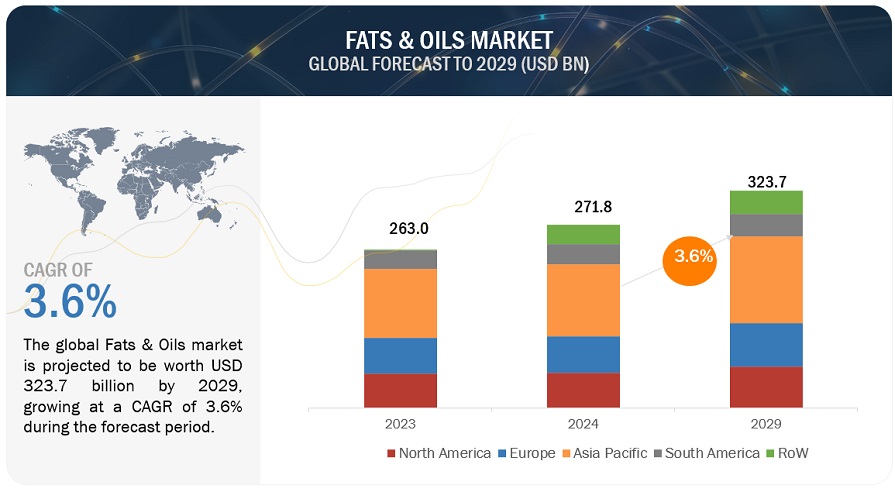

The global fats and oils market, estimated to be USD 271.8 billion in 2024, showcases a remarkable growth projection, anticipated to escalate to USD 323.7 billion by 2029, indicating a robust compound annual growth rate (CAGR) of 3.6% during the forecast period. Current trends in dietary regimes, however, have been the major determinants of demand for particular fats and oils. Most notably, this pertains to the ketogenic keto and paleo diets. In recent years, the keto diet has been popularized for its high-fat, low-carbohydrate intake, as a method to lose weight while attaining superior levels of mental clarity and better levels of energy. It is a diet that involves high-fat intake from various oils and fats, self-induced to be in a state of ketosis, in which the body supplies its energy by burning out fats rather than carbohydrates.

According to Medical News Today, in the case of a person following the keto diet, he must derive 55%–60% of his daily calories from fat to keep himself in ketosis. Thus, recently, there has been a rush in demand for oils like coconut oil, MCT oil, and butter, all staple products within the keto community. These are oils that provide essential fats for the ketogenic diet, but they also contribute to the flavor profiles and methods of preparation that individuals following such a diet might choose.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=6198812

The butter margarine segment, among fats types, is estimated to hold the largest share throughout the forecast period.

Butter and margarine are versatile products used in an array of applications, such as cooking, baking, and spreads. Their timeless popularity rests on the base of central roles in culinary applications, appealing taste profiles, and perceived nutritional benefits. The choice between the two products in consumer segments is mostly driven by considerations of health, taste, and diet that quite often affects the market balance. Margarines are fast gaining momentum in the global market. Several factors make them an attractive option for consumers and food industries combined. Large-scale commercial production of margarine happens to be one major reason attributed to this growth at cheaper costs compared to butter, hence making it a much-preferred choice among cost-sensitive consumers and food manufacturers.

Another major factor for the rise in margarine demand is the growth of the bakery and confectionery markets. These industries vastly depend on margarine, as it is an all-purpose ingredient with functional properties that enable the production of a great variety of different bakery and confectionery products. The solid fat content, consistency, and melting point of fats used in margarine are of critical importance for its performance for various culinary purposes; hence, margarine is an indispensable ingredient in industry.

The liquid category within the fats and oils segment maintains a significant position throughout the forecast period.

Most vegetable oils, such as olive oil, canola oil, sunflower oil, and other related oils derived from plants, are generally regarded as healthier than solid fats because of their lower content in saturated fat and higher presence of unsaturated fats. Most of these plant-based oils have different health impacts, which include improved heart health and a reduction in the levels of cholesterol—messages that easily appeal to the health-conscious consumer.

Moreover, new tastes and new foodstuffs emerging in the food industry are contributing to the popularity of liquid oils. Liquid fats become favourite for a myriad uses, starting from cooking and frying to dressings and baking. With its ease of use and flavor- and texture-enhancing ability in foods, it is now one of the major ingredients used in homes and commercial food manufacturing.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=6198812

In Asia Pacific, China is poised to maintain its dominant position within the fats oils market throughout the forecast period.

China stands as one of the world's major consumers of cooking oil, alongside Europe and the United States. In 2022, according to the Malaysian Palm Oil Council, total oils and fats consumption in China was estimated to have dropped for the very first time ever by 5.5% in 2022 to 39.49 million metric tons. Although this indicates a drop in consumption, the total volume still reflects the huge consumption in China.

China consumes several types of edible oils in abundance, of which soybean oil comes at the top and presents a bigger market share. Regional staple oil consumption differences reflect the wide range of culinary diversity in the country. On top of that comes the trend of Western oils and fats, represented by olive oil and butter, reflecting changing consumer preferences in diversified diets.

It also shows something about consumption patterns: dietary habits and health awareness. As China Food Hygiene Magazine has reported, 50.72 percent of adults, from ages 18 to 59, consume more cooking oil than the recommended maximum intake of 30 grams per person per day. For consumption rates, the highest ranking ones are rapeseed oil, peanut oil, and sesame oil; for volume, it is rapeseed oil, peanut oil, and soybean oil. Hence, growing health concerns and significant cultural, economic, and lifestyle drivers in China ensure its continued dominance in the Asia Pacific fats and oils market.

The key players in the market are ADM (US), Wilmar International Ltd (Singapore), Cargill, Incorporated (US), Bunge (US), Kaula Lumpur Kepong Berhad (Malaysia), Olam Agri Holdings Pte Ltd (India), Manildra Group (Australia), Mewah Group (Singapore), Associated British Foods plc (UK), United Plantations Berhad (Malaysia), Ajinomoto Co., Inc. (Japan), Fuji Oil Co., Ltd. (Japan), Oleo-Fats (Philippines), Borges Agricultural and Industrial Edible Oils, S.A.U. (Spain), K S Oils Limited (India), CSM Ingredients (US), SD Guthrie International Zwijndrecht Refinery B.V. (Netherlands), Musim Mas Group (Singapore), Richardson International Limited (Canada), and AAK AB (Sweden).